Club Perks

FREE TO JOIN — NO OBLIGATION

Money Towards Closing Costs

Down Payment Boosting

Credit Support Options

VIP Event Invites

New Home Resource Guide

Our Buyers Club is your go-to resource for buying a home in Texas.

We’re here to help you navigate every step of your new home journey with confidence.

CURRENT AND ONGOING SAVINGS & FINANCIAL TOOLS

Up to

$3,500

towards closing costs*

When you participate in the Buyers Club, you can qualify for cash towards closing costs.* Just one more way we’re making homeownership more accessible.

Down Payment Boosting Tools

Grow your down payment faster with HomeFundIt®—get gifts from family and friends, plus up to $2,000 in matching funds.

Educational Events & One-On-One Support

Buying a home comes with big questions—and we’re here with answers. Enjoy access to expert-led events and personalized support tailored to your homeownership journey.

Financial

Programs

From credit repair tools and saving strategies to financial programs like HomeFundIt®, we’re committed to helping you overcome barriers and reach your goals.

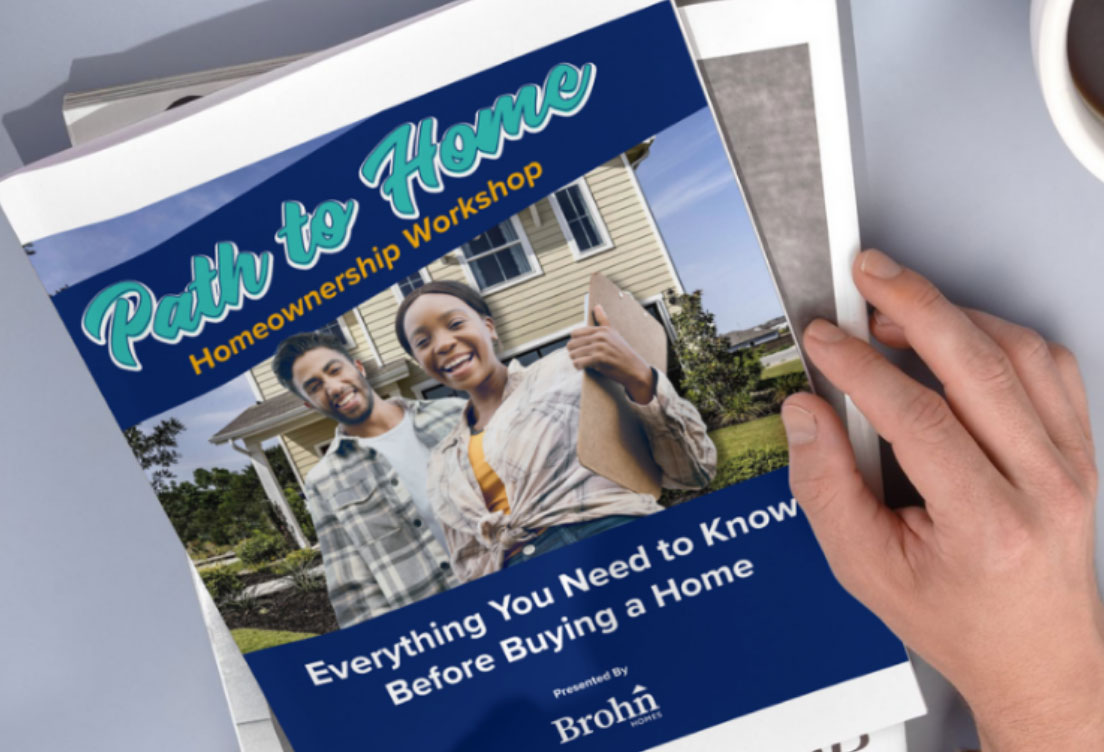

FREE Handbook for New Homebuyers

This free guide is yours—whether you’re a Buyer’s Club member or just getting started. Start your homebuying journey with our easy step-by-step handbook with everything you need to know before buying a home.

The Resource Center

Videos, Blogs and Helpful Tools

We’ve created a growing library of videos, blogs, and helpful tools to guide you through the homebuying journey. Whether you’re researching your first steps or learning what happens at closing, these resources are built to make the process feel more approachable—and a little less overwhelming.

For even more support—like cash toward closing costs, down payment boosting tools, invites to educational events, guidance and more—join the Brohn Buyers Club today.

Join the Brohn Buyers Club

Up to $1,500 is dependent on buyer having been enrolled in a credit repair program through a credit repair company. Proof of program completion and receipt of costs for company/program must be presented to qualify. Reimbursement of up to $1,500 will be contributed as closing costs at closing on a Brohn home. ** Exact contribution amount varies and is subject to change. HomeFundIt™ is a service provided by CMG Home Loans. CMG Mortgage, Inc. dba CMG Home Loans, NMLS ID# 1820 (www.nmlsconsumeraccess.org, www.cmghomeloans.com), Equal Housing Opportunity. Licensed by the Department of Financial Protection and Innovation (DFPI) under the California Residential Mortgage Lending Act No. 4150025.; AZ #0903132; Colorado regulated by the Division of Real Estate; Georgia Residential Mortgage Licensee #15438; Mortgage Servicer License No. MS068. Hawaii Mortgage Loan Originator Company License No. HI-1820. Massachusetts Mortgage Lender License #MC1820 and Mortgage Broker License #MC1820; Mississippi Licensed Mortgage Company Licensed by the Mississippi Department of Banking and Consumer Finance; Licensed by the New Hampshire Banking Department; Licensed by the NJ Department of Banking and Insurance; Licensed Mortgage Banker – NYS Department of Financial Services; Ohio Mortgage Broker Act Mortgage Banker Exemption #MBMB.850204.000; Rhode Island Licensed Lender #20142986LL; Registered Mortgage Banker with the Texas Department of Savings and Mortgage Lending, and Licensed by the Virginia State Corporation Commission #MC-5521. CMG Mortgage, Inc. is licensed in all 50 states, the District of Columbia, and Guam, Puerto Rico, and the U.S. Virgin Islands. www.cmgfi.com/corporate/licensing.

Your Financial Toolkit for Buying a Home

Joining the Brohn Buyers Club opens the door to real financial advantages. From matching funds and gifting platforms to credit support and cash for closing costs, these tools are designed to help you get “home” faster.

Explore how each benefit works—and join the Club when you’re ready to unlock them.

Turn Gifts Into Your New Home

As part of the Brohn Buyers Club, we’re committed to supporting you every step of the way—including improving your credit score. Our partner lender offers credit enhancement services designed to help you strengthen your credit profile, making the path to homeownership even smoother.

Brohn Reimburses Up To $1,500* for Credit Repair at Closing Towards Closing Costs.

Get Your Unique Link

Receive down payment gifts instantly from family and friends using our simple, online platform.

Share Your Story

Whether through social media, email, or personal messages, we believe that homeownership is a dream best shared with the people that matter most.

Grow Your Funds

Watch your down payment fund grow as family, friends, and even everyday purchases help boost your savings.

Plus get up to a $2000* match from our partner lender for first-time homebuyers. AND Brohn is reimbursing up to $1,500* at closing for closing costs if Credit Repair is needed.

Buy Your Home

With the support of your community and the Brohn Buyers Club you’ve taken a huge step toward homeownership – and now, it’s time to enjoy it!

Four Ways to Boost the Down Payment for Your New Home

Whether you’re planning a wedding, celebrating a milestone, or simply sharing your dream of owning a new home, our partner lender’s HomeFundIt Program helps you bring your community together. It’s free to signup and there are zero fees – everything goes to your down payment!

Down Payment Gifting

Receive down payment gifts instantly from family and friends using our simple, online platform.

Shop to Save

Earn additional contributions toward your down payment while you shop at over 1,000 partnered online retailers.

Closing Cost Grant

Get up to $2,000** toward closing costs from our partner lender, who will match every $1 you receive with $2.

Towards Closing Costs

If credit repair is needed, Brohn will reimburse up to $1,500* at closing for closing costs.

Bringing New Home Dreams to Life: See How Other Families Did It

Credit Enhancement for Your New Home

As part of the Brohn Buyers Club, we’re committed to supporting you every step of the way—including improving your credit score. Our partner lender offers credit enhancement services designed to help you strengthen your credit profile, making the path to homeownership even smoother.

Brohn Reimburses Up To $1,500* for Credit Repair at Closing Towards Closing Costs.

Join the Brohn Buyers Club

Up to $1,500 is dependent on buyer having been enrolled in a credit repair program through a credit repair company. Proof of program completion and receipt of costs for company/program must be presented to qualify. Reimbursement of up to $1,500 will be contributed as closing costs at closing on a Brohn home. ** Exact contribution amount varies and is subject to change. HomeFundIt™ is a service provided by CMG Home Loans. CMG Mortgage, Inc. dba CMG Home Loans, NMLS ID# 1820 (www.nmlsconsumeraccess.org, www.cmghomeloans.com), Equal Housing Opportunity. Licensed by the Department of Financial Protection and Innovation (DFPI) under the California Residential Mortgage Lending Act No. 4150025.; AZ #0903132; Colorado regulated by the Division of Real Estate; Georgia Residential Mortgage Licensee #15438; Mortgage Servicer License No. MS068. Hawaii Mortgage Loan Originator Company License No. HI-1820. Massachusetts Mortgage Lender License #MC1820 and Mortgage Broker License #MC1820; Mississippi Licensed Mortgage Company Licensed by the Mississippi Department of Banking and Consumer Finance; Licensed by the New Hampshire Banking Department; Licensed by the NJ Department of Banking and Insurance; Licensed Mortgage Banker – NYS Department of Financial Services; Ohio Mortgage Broker Act Mortgage Banker Exemption #MBMB.850204.000; Rhode Island Licensed Lender #20142986LL; Registered Mortgage Banker with the Texas Department of Savings and Mortgage Lending, and Licensed by the Virginia State Corporation Commission #MC-5521. CMG Mortgage, Inc. is licensed in all 50 states, the District of Columbia, and Guam, Puerto Rico, and the U.S. Virgin Islands. www.cmgfi.com/corporate/licensing.

RESOURCES

Filter By Topic

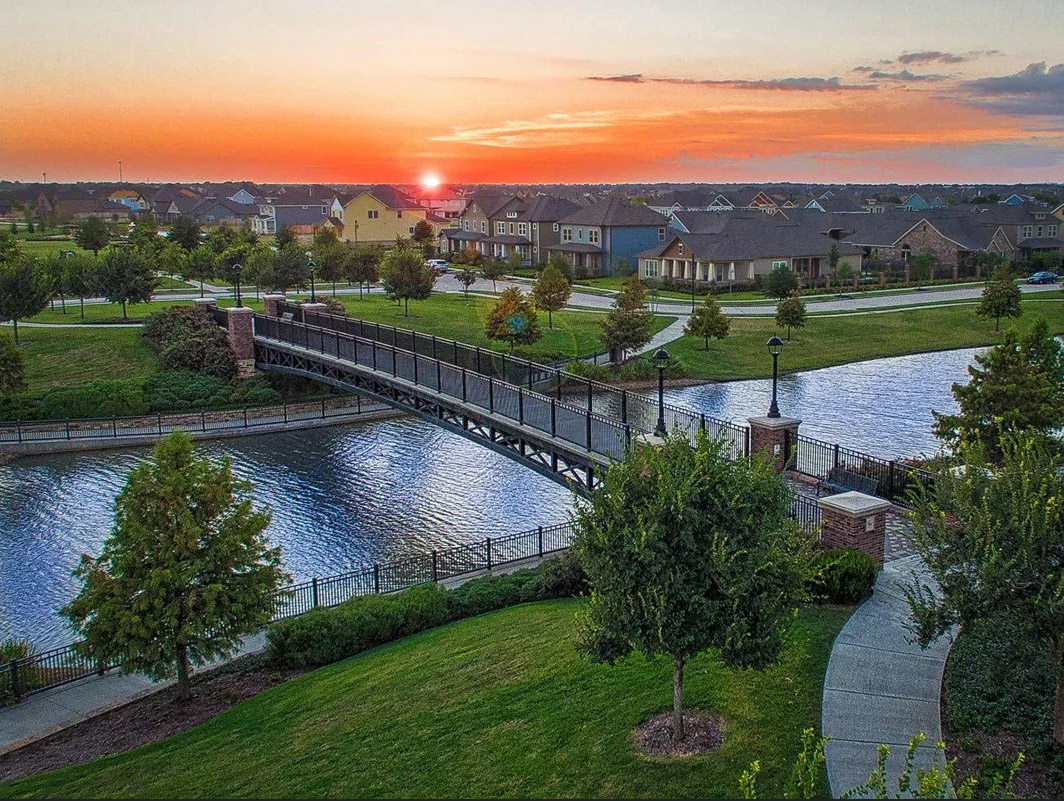

Live in Liberty Hill, Where Small-Town Charm Meets Big New Home Opportunities

Have you wondered what it would be like to live in Liberty Hill? Located 35 miles north of downtown Austin, Texas, and just minutes from Georgetown, Liberty Hill is surrounded by the breathtaking rolling hills of the Texas Hill Country. This vibrant community features a charming historic downtown district with…

City Living in Cloverleaf Without the Downtown Austin Prices

Downtown Austin brims with energy and excitement, offering a vibrant atmosphere, a variety of activities, and many spots to explore and enjoy. Although it’s an excellent area to visit, buying a home there comes with challenges, including parking issues, a higher cost of living, and safety concerns. Living just a few minutes farther away at Cloverleaf in South…

Design Inspiration from the Hunters Ranch Model Home in San Antonio

When we designed the Hunters Ranch model home in San Antonio, our goal was simple, but not easy. We wanted to create a professionally designed home that still feels personal, warm, and attainable, while also offering DIY design inspiration homeowners can realistically recreate. We wanted visitors to walk through the…

Texas New Home Care This Spring: Tips from the Brohn Homes Warranty Team

Spring is a season of renewal, and it’s also one of the most important times of year to think about new home care in Texas. Even in a newly built home, seasonal maintenance plays an important role in protecting your investment and ensuring your home continues to perform as designed…

New Home Houston Guide: Top Places to Live Near Houston with Brohn Homes

Why So Many People Are Choosing a New Home in Houston If you’re searching for a new home, it’s easy to see why the Houston metro area continues to attract families, professionals, and retirees alike. As one of the largest and most dynamic cities in the country, Houston offers…

Brohn Homes: 2025 – A Year of Growth, Innovation, and Milestones

2025 has been quite a year, but honestly, we wouldn’t want it any other way. At Brohn Homes, one of our greatest joys is connecting with people. We don’t just build houses. At our core, “We are in the people business, and we build homes.” That belief influences everything we do: how we serve our customers, support our team…

Other Resources

Club Perks

FREE TO JOIN — NO OBLIGATION

Money Towards Closing Costs

Down Payment Boosting Platform

Credit Support Options

VIP Event Invites

New Home Resource Guide

Join the Brohn Buyers Club

Up to $1,500 is dependent on buyer having been enrolled in a credit repair program through a credit repair company. Proof of program completion and receipt of costs for company/program must be presented to qualify. Reimbursement of up to $1,500 will be contributed as closing costs at closing on a Brohn home. ** Exact contribution amount varies and is subject to change. HomeFundIt™ is a service provided by CMG Home Loans. CMG Mortgage, Inc. dba CMG Home Loans, NMLS ID# 1820 (www.nmlsconsumeraccess.org, www.cmghomeloans.com), Equal Housing Opportunity. Licensed by the Department of Financial Protection and Innovation (DFPI) under the California Residential Mortgage Lending Act No. 4150025.; AZ #0903132; Colorado regulated by the Division of Real Estate; Georgia Residential Mortgage Licensee #15438; Mortgage Servicer License No. MS068. Hawaii Mortgage Loan Originator Company License No. HI-1820. Massachusetts Mortgage Lender License #MC1820 and Mortgage Broker License #MC1820; Mississippi Licensed Mortgage Company Licensed by the Mississippi Department of Banking and Consumer Finance; Licensed by the New Hampshire Banking Department; Licensed by the NJ Department of Banking and Insurance; Licensed Mortgage Banker – NYS Department of Financial Services; Ohio Mortgage Broker Act Mortgage Banker Exemption #MBMB.850204.000; Rhode Island Licensed Lender #20142986LL; Registered Mortgage Banker with the Texas Department of Savings and Mortgage Lending, and Licensed by the Virginia State Corporation Commission #MC-5521. CMG Mortgage, Inc. is licensed in all 50 states, the District of Columbia, and Guam, Puerto Rico, and the U.S. Virgin Islands. www.cmgfi.com/corporate/licensing.

Filter By Topic

Homeowner Happy Hour at Clear Creek

Friends, family, and neighbors, join us at Brohn Homes Clear Creek as we come together to celebrate our community. At Brohn Homes, we believe community is more than just houses; it’s the people who bring life and love into the home. In honor of creating a stronger sense of community,…

ITIN Event at Cloverleaf

Together with CMG Financial, we’ll be giving you a rundown of the new 3.5% ITIN Program. Be the expert your buyers need! While you're here, tour our two fully furnished model homes, our spacious two-story 2460 floor plan, and our ever popular one-story 1450 plan, as well as the beautiful…

TopAgent Happy Hour Celebration – San Antonio

Calling all TopAgents - 2026 is here and we want to show you some love! Enjoy food, drinks, and raffle prizes while networking with our superb sales team, financial partners, and fellow Realtors. Whether you sold one home with us last year, or 22 (yes, someone sold 22 homes with…

Smart Start: Homebuying Basics – Cascade

Everything you need to know before buying a home. Contracts, credit scores, closing; there’s a lot to understand. That’s why we’re bringing in industry experts, including local realtor Kenn Renner and CMG Financial, to break it all down and answer every question (even the ones you didn’t know you had). Spots…

TopAgent Rodeo Happy Hour – Houston

✨ TopAgent Rodeo Happy Hour! Y’all ready for a good time? ✨ Join us at the TopAgent Rodeo Happy Hour for delicious bites, drinks, prizes, and top‑notch company! Get ready to network with fellow top agents in the industry, enjoy refreshing drinks, and unwind after a long day of hard…

Build Your Own Bouquet – Casetta Ranch

Tired of waiting for someone to bring you flowers? - Realtors, join the Brohn Homes Casetta Ranch team as we celebrate Spring with a fun Build Your Own Bouquet event! Flowers will be provided, bring yourself and a little creativity while we network, enjoy the afternoon, and create a beautiful…

Join the Brohn Buyers Club

Up to $1,500 is dependent on buyer having been enrolled in a credit repair program through a credit repair company. Proof of program completion and receipt of costs for company/program must be presented to qualify. Reimbursement of up to $1,500 will be contributed as closing costs at closing on a Brohn home. ** Exact contribution amount varies and is subject to change. HomeFundIt™ is a service provided by CMG Home Loans. CMG Mortgage, Inc. dba CMG Home Loans, NMLS ID# 1820 (www.nmlsconsumeraccess.org, www.cmghomeloans.com), Equal Housing Opportunity. Licensed by the Department of Financial Protection and Innovation (DFPI) under the California Residential Mortgage Lending Act No. 4150025.; AZ #0903132; Colorado regulated by the Division of Real Estate; Georgia Residential Mortgage Licensee #15438; Mortgage Servicer License No. MS068. Hawaii Mortgage Loan Originator Company License No. HI-1820. Massachusetts Mortgage Lender License #MC1820 and Mortgage Broker License #MC1820; Mississippi Licensed Mortgage Company Licensed by the Mississippi Department of Banking and Consumer Finance; Licensed by the New Hampshire Banking Department; Licensed by the NJ Department of Banking and Insurance; Licensed Mortgage Banker – NYS Department of Financial Services; Ohio Mortgage Broker Act Mortgage Banker Exemption #MBMB.850204.000; Rhode Island Licensed Lender #20142986LL; Registered Mortgage Banker with the Texas Department of Savings and Mortgage Lending, and Licensed by the Virginia State Corporation Commission #MC-5521. CMG Mortgage, Inc. is licensed in all 50 states, the District of Columbia, and Guam, Puerto Rico, and the U.S. Virgin Islands. www.cmgfi.com/corporate/licensing.

FAQ

Buying a New Home in Texas

It depends! Many buyers think they need 20% down, but that’s not always true. There are loan programs that allow for as little as 3% down—and some even offer down payment assistance. You’ll also need to budget for closing costs (usually 2–5% of the home’s price), but our team and trusted lenders can help you estimate those expenses upfront.

Great question! A pre-qualification is a quick estimate based on basic info you provide, while a pre-approval is a more in-depth review of your credit, income, and finances by a lender. A pre-approval gives you a clear idea of what you can afford and makes you a stronger buyer when it’s time to make an offer.

Not at all. While your credit score does affect your loan options and interest rate, there are many programs available for buyers with average or fair credit. Part of what we do in the Buyers Club is help you understand your credit and make a plan, whether you’re ready now or still working toward your goal.

A mortgage is a loan from a lender that helps you pay for your home. You’ll make monthly payments that cover the loan amount (called the principal), plus interest. Many mortgage payments also include property taxes, homeowners insurance, and possibly HOA or MUD fees—so it’s important to understand your full monthly costs.

Closing costs are fees and expenses due at the end of the homebuying process. They usually include lender fees, title services, insurance, taxes, and more. Closing costs typically range from 2% to 5% of your home’s purchase price. The good news? Many builders—including Brohn—offer incentives that can help cover some or all of these costs.

It depends on your preferences, timeline, and priorities. New homes often include modern layouts, energy-efficient features, and warranties—and you won’t need to worry about costly repairs or renovations. Plus, with Brohn, many upgrades come standard, which means more value from the start. You’ll also have peace of mind knowing your home is backed by our award-winning warranty team, here to support you long after move-in day.

It varies based on your financing, whether you’re building from the ground up or buying a quick move-in home, and other personal factors. Some buyers close in 30 days; others may spend a few months planning and preparing. The Buyers Club is here to help you move at your pace and stay informed every step of the way.

That’s okay! Many of our Buyers Club members join early so they can ask questions, understand their finances, and make a smart plan. Whether you’re six weeks or six months away from buying, we’re here to support you.

At Brohn, we believe you should get more home for your money—without compromise. Our homes are thoughtfully designed, energy efficient, and include features that many other builders treat as upgrades. From appliances to landscaping, we include more so you can stress less and settle in faster.

We’re proudly founded and operated right here in Texas and we’re committed to building homes for Texans, backed by heart. That local connection shows up in everything we do, from the neighborhoods we choose to the customer care we provide. We’re not a national brand trying to fit in—we’re part of the communities we serve.

Yes! Giving back is a core part of who we are. Whether it’s supporting local nonprofits, volunteering, or creating opportunities for homeownership, we believe strong communities start with strong values. When you buy a Brohn home, you’re supporting a company that invests in the place we all call home.

Join the Brohn Buyers Club

Up to $1,500 is dependent on buyer having been enrolled in a credit repair program through a credit repair company. Proof of program completion and receipt of costs for company/program must be presented to qualify. Reimbursement of up to $1,500 will be contributed as closing costs at closing on a Brohn home. ** Exact contribution amount varies and is subject to change. HomeFundIt™ is a service provided by CMG Home Loans. CMG Mortgage, Inc. dba CMG Home Loans, NMLS ID# 1820 (www.nmlsconsumeraccess.org, www.cmghomeloans.com), Equal Housing Opportunity. Licensed by the Department of Financial Protection and Innovation (DFPI) under the California Residential Mortgage Lending Act No. 4150025.; AZ #0903132; Colorado regulated by the Division of Real Estate; Georgia Residential Mortgage Licensee #15438; Mortgage Servicer License No. MS068. Hawaii Mortgage Loan Originator Company License No. HI-1820. Massachusetts Mortgage Lender License #MC1820 and Mortgage Broker License #MC1820; Mississippi Licensed Mortgage Company Licensed by the Mississippi Department of Banking and Consumer Finance; Licensed by the New Hampshire Banking Department; Licensed by the NJ Department of Banking and Insurance; Licensed Mortgage Banker – NYS Department of Financial Services; Ohio Mortgage Broker Act Mortgage Banker Exemption #MBMB.850204.000; Rhode Island Licensed Lender #20142986LL; Registered Mortgage Banker with the Texas Department of Savings and Mortgage Lending, and Licensed by the Virginia State Corporation Commission #MC-5521. CMG Mortgage, Inc. is licensed in all 50 states, the District of Columbia, and Guam, Puerto Rico, and the U.S. Virgin Islands. www.cmgfi.com/corporate/licensing.